PALM token

Introduction: Palmyra is a next-generation full-service supply-chain solution for commodities that are semi-fungible and currently have limited access to traditional capital markets. It combines the operational and capital efficiency of smart contracts with a real-world asset base, product demand and catalytic economic effects.

The platform consists of a native token (PALM) that captures and recycles protocol fees in order to provide a rebate system for users As an integral component of the Palmyra project, the PALM token has been meticulously designed to ensure its value, utility, and sustainability in the evolving digital landscape.

Utility Overview

The core economic utility function of the PALM token is staked by users of the platform to claim a rebate on fees paid during the respective calculation period.Whilst the allocation of rebate is proportional to the amount of PALM staked by the user, it is also limited to the amount of fees paid (and cannot exceed). The token inflation and incentive model is designed to reward true economic contribution and enable decentralized business development through its treasury function. It also employs a unique oracle system that is fully decentralized and deals with on-chain data, resolution and collateral modelled resources.

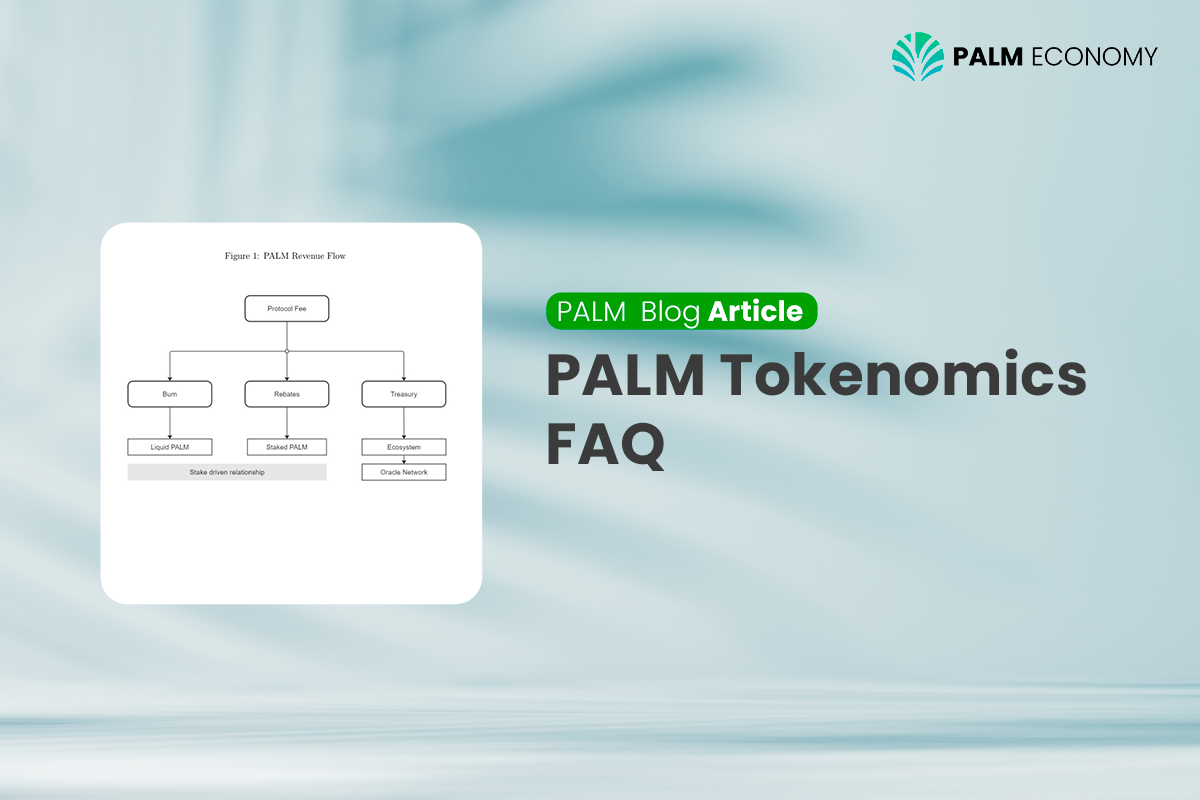

Palmyra charges varying fees for all platform transactions which is recycled into the PALM token.

The core economic utility function of the PALM token is staked by users of the platform to claim a rebate on fees paid during the respective calculation period.

Whilst the allocation of rebate is proportional to the amount of PALM staked by the user, it is also limited to the amount of fees paid (and cannot exceed).

The token inflation and incentive model is designed to reward true economic contribution and enable decentralized business development through its treasury

function. It also employs a unique oracle system that is fully decentralized and deals with on-chain data, resolution and collateral modelled recourses. Revenue

is converted into PALM and then allocated as below:

- Fee rebates: Calculated according to staking process. Rebated are capped by fees paid.

- Burn: Dynamic as a function of the staking state of the system.

- Treasury: Net difference goes into the treasury for ecosystem and business development (including paying specialist oracle providers).

- Oracles: Off chain data verification

The PALM token serves as a mechanism for users to claim rebates on fees paid during a specific calculation period.

The core economic utility of PALM is its staking feature. Users stake PALM tokens to be eligible for these rebates. The allocation of the rebate is proportional

to the amount of PALM staked by the user, but it's capped by the amount of fees they've paid. Essentially, the more PALM a user stakes, the higher the rebate

they can claim, up to the limit of fees they've paid.

Palmyra employs a unique and decentralized oracle system. Oracles are crucial in the blockchain ecosystem as they provide off-chain data to smart contracts

on the blockchain. The PALM token plays a role in this by compensating oracle providers. The system deals with on-chain data, resolution, and collateral

modeled recourse. This ensures that the data fed into the Palmyra platform is accurate, reliable, and verified, enhancing the platform's credibility and

functionality.

The PALM tokenomics includes a dynamic burn mechanism. This is determined by the staking state of the system.

The treasury function of the PALM token is designed to support ecosystem and business development.

A portion of the protocol's revenue is allocated to the treasury. This includes the net difference from the fee rebates and any surplus from mismatches in

staking. The funds in the treasury are used for various purposes, including compensating specialist oracle providers and other initiatives that contribute to the

growth and sustainability of the Palmyra ecosystem.

PALM token holders possess more than just economic utilities; they also play a pivotal role in the governance of the Palmyra platform. When business

development proposals arise, especially those concerning the allocation and use of the treasury, PALM token holders have the privilege to voice their opinions

and cast their votes. This decentralized approach ensures that the community is actively involved in shaping the platform's future, fostering a sense of

ownership and alignment with Palmyra's long-term vision. By granting token holders the power to vote, Palmyra underscores its commitment to transparency,

inclusivity, and community-driven decision-making.